Source : Columbia Threadneedle Investments. Data as at 03.07.2025.

Past performance should not be seen as an indication of future performance.

The fund aims to give investors access to the income and growth potential of real estate investment. Through an innovative hybrid structure blending physical UK property assets and an actively managed allocation to listed European real estate, the fund aims to tap into return drivers in targeted high quality property assets. At the same time, allocating to listed property helps the team counter liquidity challenges and other constraints typically impacting real estate investments.

The CT Property Growth & Income Fund comprises UK physical property assets and pan-European real estate securities. We believe that our approach gives investors the best attributes of property investment whilst avoiding some of the negative aspects associated with investing purely in physical or listed property assets.

We target UK commercial properties typically in the £2-10m price range – a market segment offering broad choice and clear differentiation from the bigger assets favoured by larger funds. We focus on higher-yielding assets with average lease length of five years. We are hands-on owners with an active approach to property and tenant management.

Discover more about the CT Property Growth & Income Fund:

https://www.columbiathreadneedle.com/en/gb/intermediary/campaign/ct-property-growth-income/

Property with liquid benefits

https://players.brightcove.net/6165065629001/default_default/index.html?videoId=6370229477112

Why now for property?

https://players.brightcove.net/6165065629001/default_default/index.html?videoId=6370229670112

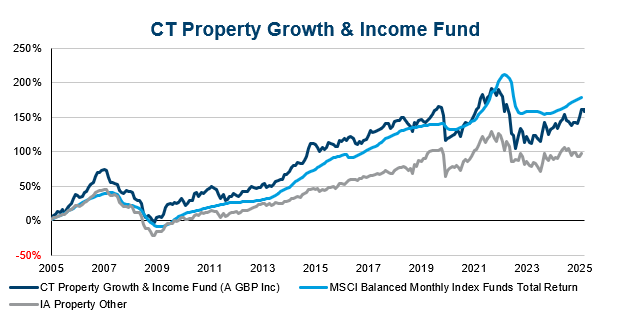

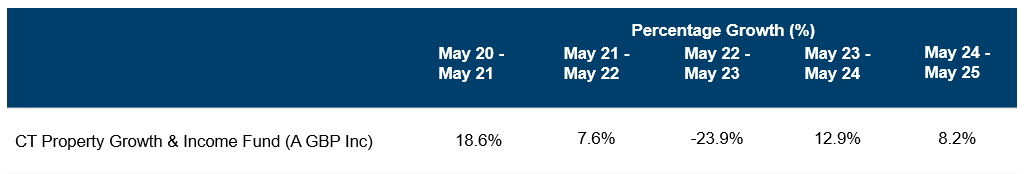

Performance graphs and standardised table

Source : Columbia Threadneedle Investments. Data as at 03.07.2025.

Source : Columbia Threadneedle Investments. Data as at 04.07.2025

CT Property Growth & Income factsheet:

CT Property Growth & Income brochures:

CT Annual Report with Accounts: