CT UK High Income Trust aims to provide shareholders with an attractive level of income together with the opportunity for capital growth. The Trust invests predominantly in UK equities but does have c. 10% in European equities where there is a unique opportunity to invest in market-leading companies that are not listed in the UK.

Investment is focused on a portfolio of quality businesses that aim to deliver a high level of growing income for the future alongside capital growth for shareholders.

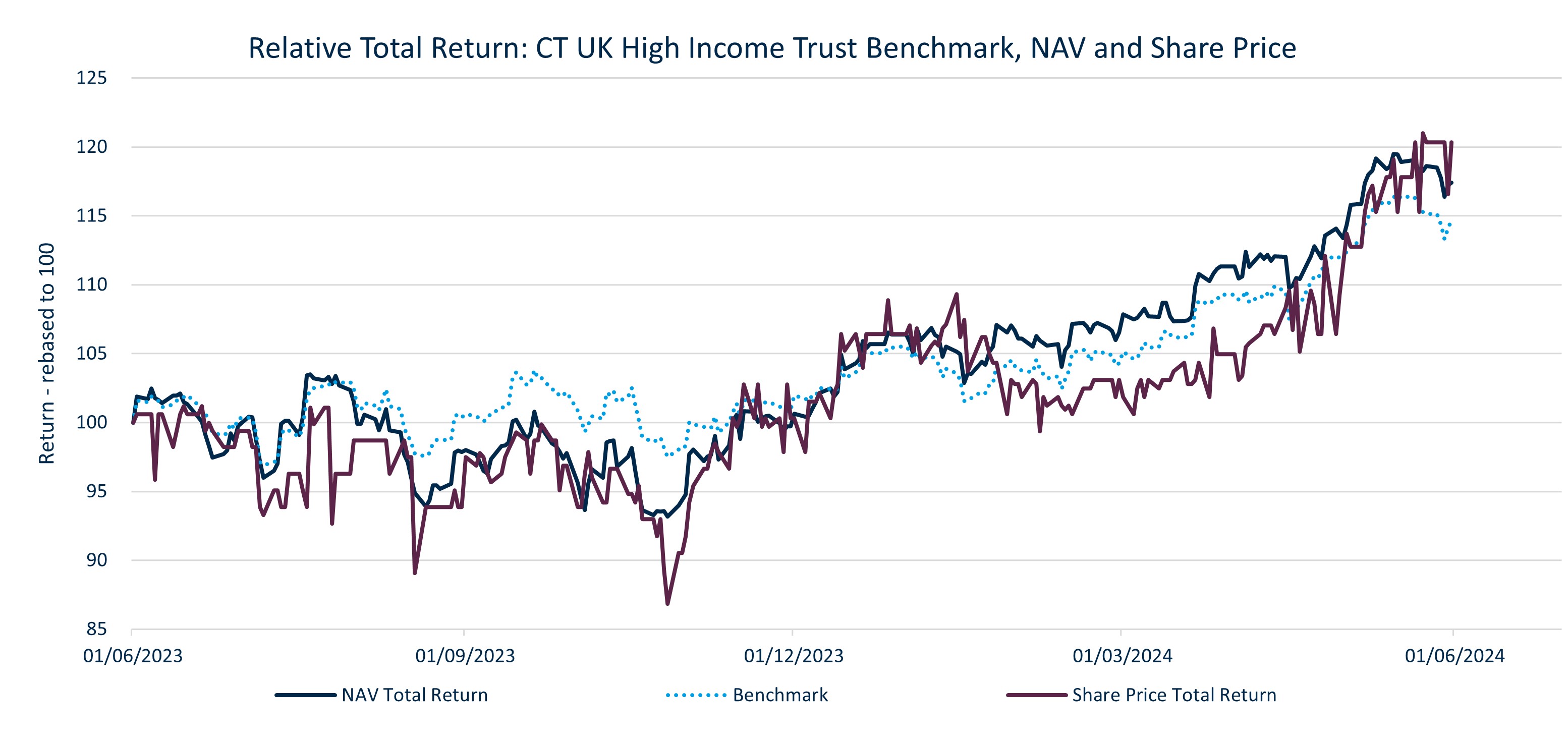

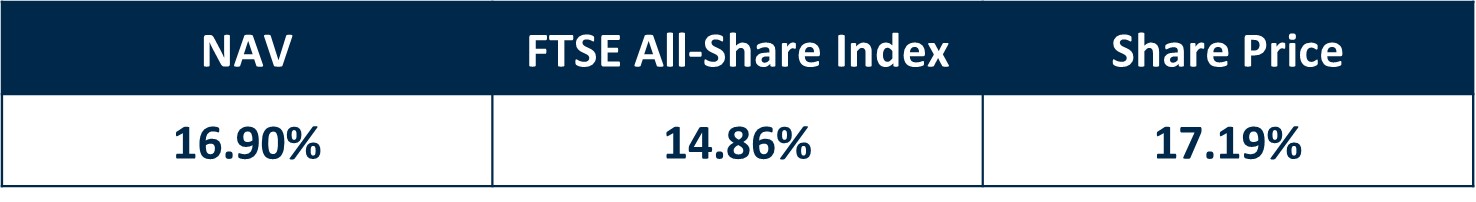

Source material to be included: Data from 1st June 2023 to 24th June 2024. 1st June 2023 taken as 100.

CT High Income Trust Factsheet

CT High Income Trust Factsheet

CT UK High Income Trust PLC- Annual Report Accounts 2025

https://www.columbiathreadneedle.co.uk/uk-high-income-trust-plc/